Need Leads?

Your CRM Should Be Getting You Leads Everyday.

FreedomSoft is more than a powerful CRM, it's one login to run your entire business.

Everything You'll Ever Need To Help

You Find & Close More Deals

…from powerful lead getting tools, to real-time COMPS & up-to-date data, to a

seamless marketing & follow-up automation system, we've got it all.

Instant Access to All the Leads

You'll Ever Need… Nationwide.

You'll Ever Need… Nationwide.

Build Motivated Seller, Cash Buyer & Private Lender Lists With A Few Clicks

0

MOTIVATED SELLER LEADS

0

CASH BUYER LEADS

0

PRIVATE LENDER LEADS

0

MOTIVATED SELLER LEADS

0

CASH BUYER

LEADS

0

PRIVATE LENDER LEADS

FreedomSoft is available to you and your team

Build All Your Marketing Lists With

Accurate & Up-to-Date Data

-

155+ Million Properties Nationwide

-

7+ Million Vacant Motivated Seller Leads

-

8+ Million Cash & Active Buyer Leads

-

List Building Wizard Guides You Step-by-Step

-

Build 100's of Custom Lists w/ Ease

Build All Your Marketing Lists With

Accurate & Up-to-Date Data

-

155+ Million Properties Nationwide

-

7+ Million Vacant Motivated Seller Leads

-

8+ Million Cash & Active Buyer Leads

-

List Building Wizard Guides You Step-by-Step

-

Build 100's of Custom Lists w/ Ease

Using Property Snapshots You Can Quickly

Research Every Property Nationwide

-

Instant Access To Sales & Rental Comps

-

Sellers, Buyers, Lenders & Mortgage Data

-

Motivation Icons Find Hidden Opportunity

-

Property Details, Pictures & Street View

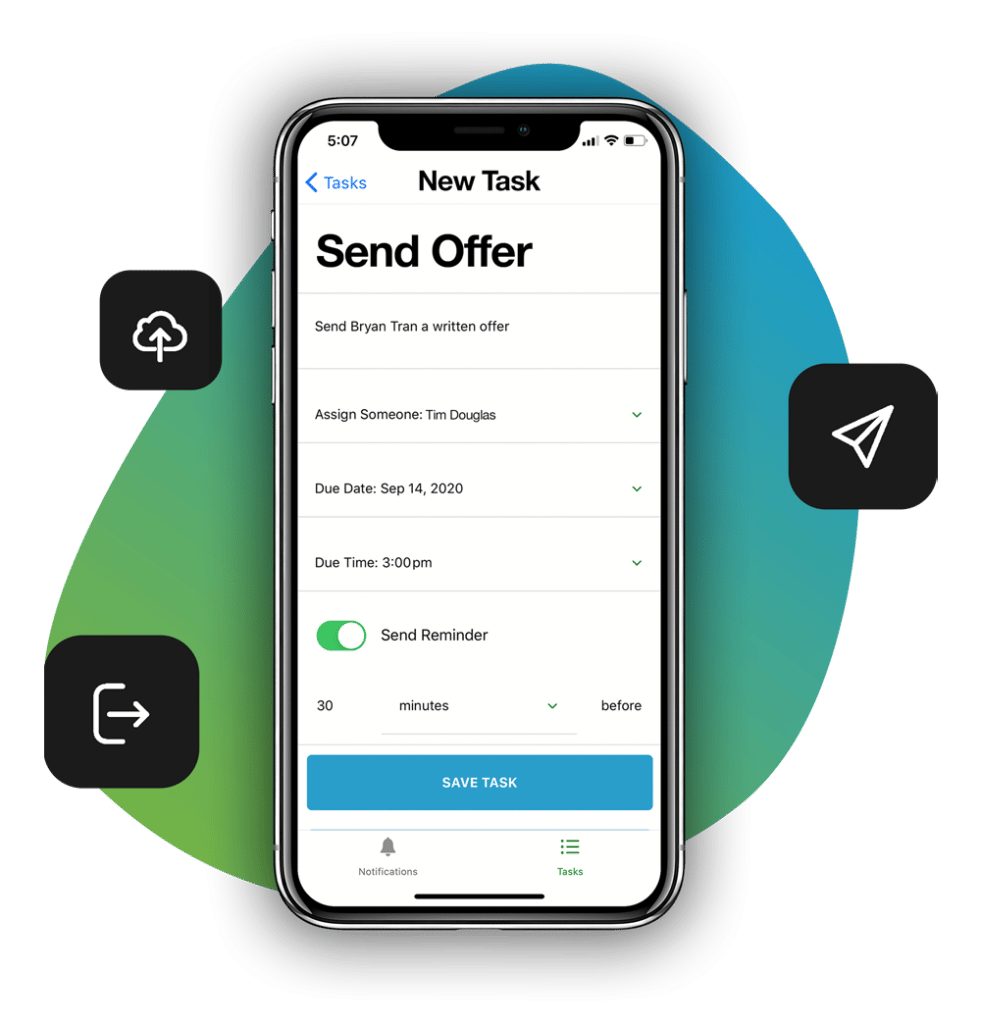

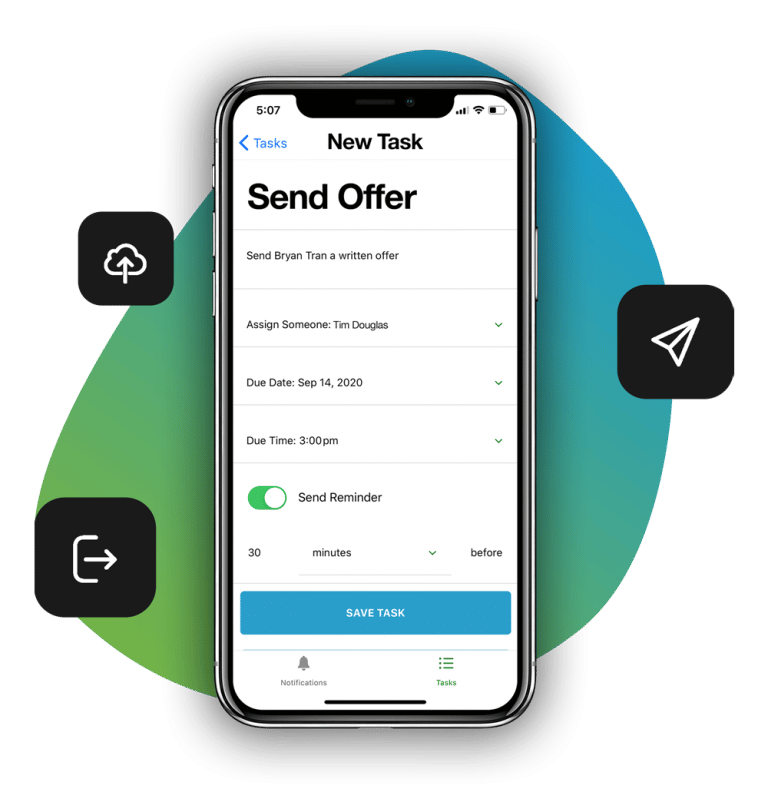

Task & Team Management Tools Help You

Get More Done & Eliminates Stress

-

Set Permission Levels For Every User

-

Track Performance & Easily Monitor KPI's

-

Create, Assign & Schedule Tasks w/ Ease

Task & Team Management Tools Help You

Get More Done & Eliminates Stress

-

Set Permission Levels For Every User

-

Track Performance & Easily Monitor KPI's

-

Create, Assign & Schedule Tasks w/ Ease

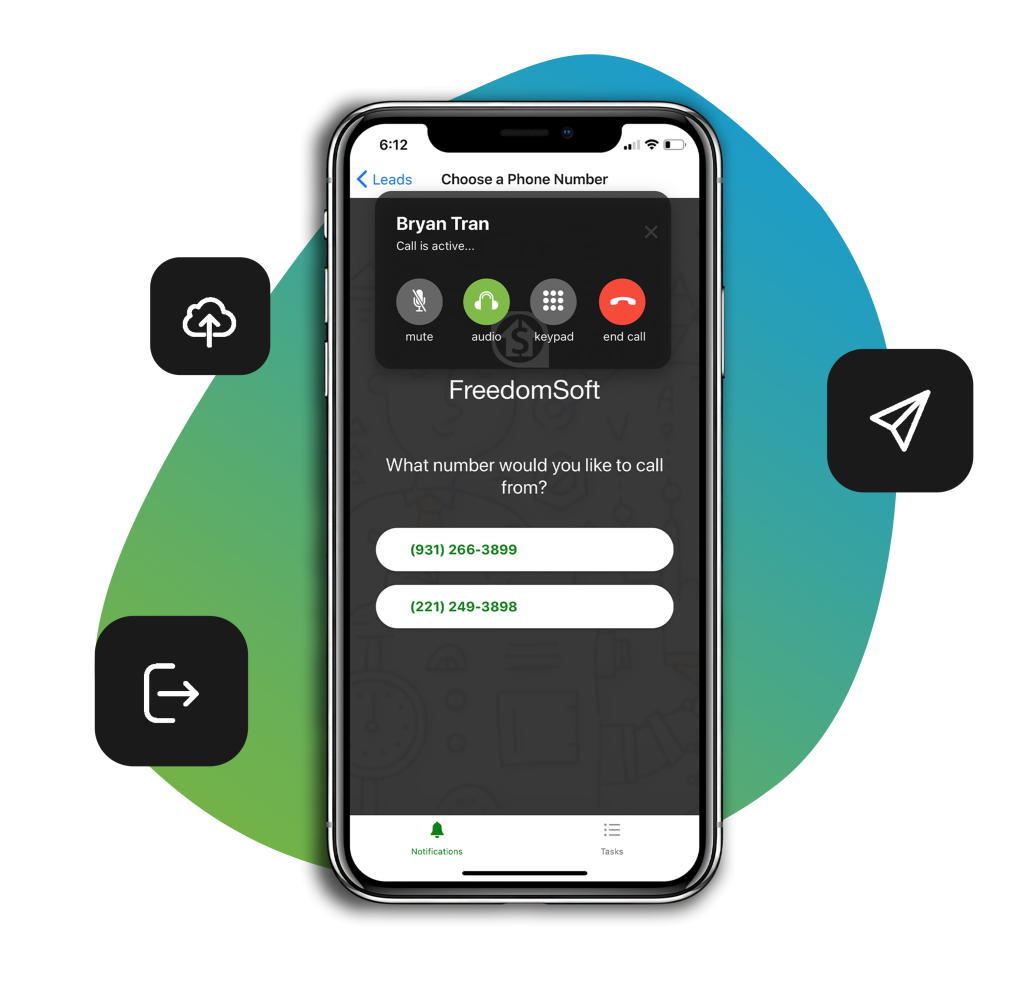

Every Phone Feature You Ever Wanted

Ready-to-Go Out of The Box

-

Make, Receive & Record Calls (All Devices)

-

2-Way Text Messaging - Highest Delivery

-

Never Miss A Lead w/ Custom Schedules

The Native iPhone & Android App Keeps You

Closing Deals Even When You're On The Go...

Download Native iPhone Or Android Apps

Free Yourself From Your Desk, Get In The Field & Close More Deals - Starting Today

Free Yourself From Your Desk, Get In The Field & More Close Deals - Starting Today

The Power Of FreedomSoft In The Palm Of Your Hand

Instantly Sync Your Mobile App & Desktop CRM

Create, Assign & Manage Tasks To Get More Done

Easily Trigger Workflow & Follow-Up Automation

2-Way Texting & Lead Follow-Up In The Field

& On The Go

Easily Make, Receive, & Record Calls In The App

The Power Of FreedomSoft In The Palm Of Your Hand

2-Way Texting & Lead Follow-Up In The Field

& On The Go

Create, Assign & Manage Tasks To Get More Done

Instantly Sync Your Mobile App & Desktop CRM

Easily Trigger Workflow & Follow-Up Automation

Easily Make, Receive, & Record Calls In The App

Abandon Your Inferior CRM Today Because

Switching To FreedomSoft Is Simple

Claim This FREE GUIDE Right Now

INSTANT DOWNLOAD

5 Steps Makes Switching To FreedomSoft In Under 30 Minutes So Simple (For Real)

Do More With FreedomSoft Integrations

FreedomSoft's native integration with Zapier allows you to connect with 5,000+ of the most popular apps. You can create thousands of custom integrations to do anything you want – with no code required.

-

Connects with 5000+ of the most used business tools

-

Create custom reporting, data imports & a whole lot more...

-

Push & pull data into and out of FreedomSoft with ease

Become Our Next

Success Story.

Our multi-market company couldn't survive a day without FreedomSoft! We process hundreds of leads per week and use it for every part of our business. My favorite part - it's pretty much ready out of the box!

Tag T

CEO

I've been using FreedomSoft for 6 years. I love how organized and easy it is for my VAs to run my wholesale business in it. We love the interface. It's truly worth every penny and should cost more for all the value it provides.

Hugo C

Owner

We've grown from 20 or so deals per year to averaging 50 deals and 10 rehabs with a team of 8 virtual partners in 3 states. FreedomSoft has been our secret weapon and an indispensable tool. There is no better product out there. Period.

Dean B

Partner

FreedomSoft has taken us to the next level. The seamless integration of all the key elements like leads, skip tracing, sms broadcast and CRM are top notch. Ability to restrict user access to certain data is awesome!

Nick L

Owner

I love FreedomSoft because I'm a tech idiot and even I can figure it out. Things are simple and laid out so they make sense. Oh and I have tried the other big names and it was a disaster. Way over complicated. I’m a wholesaler not a computer engineer!

David O

Partner

Thousands of Real Estate Investors Can't Be Wrong...

...making FreedomSoft one of America's Fastest Growing Companies.